Discover a comprehensive, expert-level analysis of Sunrun Inc (Sunrun Inc (RUN) Stock Today) stock price today, including live updates, real-time market trends, and long-term investment outlook. This article breaks down RUN’s recent sharp price dip, key drivers behind its volatility, and how new federal policies and clean energy tax credits are shaping the solar energy giant’s future. Whether you’re a seasoned investor or just exploring renewable energy stocks, get insights into Sunrun’s fundamentals, analyst price targets, and risk-reward balance.

🌞 1. Sunrun Stock Live Snapshot

- Ticker Symbol: RUN (Nasdaq)

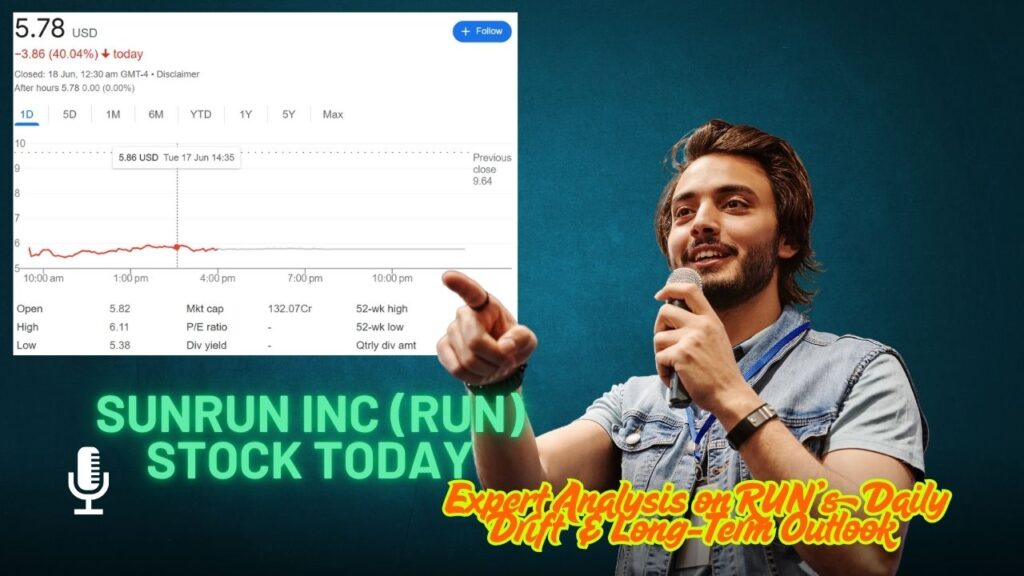

- Live Price: $5.78 (down ~0.4% intraday)

- Today’s Range: $5.39 – $7.37

- 52‑Week Range: $5.38 – $22.26

SUNRUN stock has retraced significantly from last year’s highs, weighed down heavily by recent policy changes in clean-energy tax incentives.

🌐 2. Market Headwinds: Why RUN Shares Are Down

On June 17–18, RUN dropped approximately 40% intraday, closing near $5.78—its lowest level in months. The catalyst? A sweeping congressional move to eliminate federal tax credits for residential solar and wind power by 2028

- Senate bill rollback: Eliminates solar incentives faster than previously expected.

- Market reaction: RUN plunged ~40%, wiping out over $860 million in market cap overnight

- Analyst outlook: Citi downgraded to “sell”, while others like KeyBanc remain cautious amid regulatory uncertainty

🔍 3. Chart Analysis & Key Technical Levels

Investopedia notes that weekly RBUN charts are in a “falling three methods” downtrend and a “death cross”—a bearish signal when the 50‑week MA crosses below the 200‑week MA .

- Primary support: $4.75—if it breaks, price could dip to $4.33

- Resistance zones: Near $8.50; a breakout could lead toward $13.25

With extreme volatility and high trading volume, short-term moves remain jittery and unpredictable.

Reddit Stock Price Prediction 2025

How to Start Mutual Fund Investment in the USA

Lockheed Martin (LMT) Stock Price Today & P/E Ratio Explained

💼 4. Fundamentals: Earnings, Debt & Valuation

Sunrun remains unprofitable, carrying a heavy debt load—common among energy infrastructure firms:

- TTM Revenue: $2.08 B; Net Loss: (-$2.71 B)

- Non‑GAAP EPS: $1.79? But operating loss due to subsidy timing and high project financing

- Debt/Equity Ratio: ~5.1 — extremely leveraged .

- Short Interest: 27.5% of float

- Technical Rating: Strong Sell; Fundamental Rating: 2/10 on ChartMill

🧭 5. Analyst Sentiment & Price Targets

Current analyst consensus is bullish, despite recent volatility:

- 22 analysts rate RUN as “Buy” on StockAnalysis.com, with average 12‑month target $14.21 (≈146% upside)

- TipRanks shows consensus target $10.99 (range $4–$20), about 90% upside

- ChartMill/TREND: Average target ~$11.99 (+107%)

While analysts foresee long-term growth, timing depends heavily on policy direction and project execution.

🛠️ 6. Growth Drivers & Strategic Risks

Key Growth Catalysts:

- Residential solar demand: Rising utility rates push more homeowners toward solar plus battery systems.

- Battery storage & VPP (Virtual Power Plant): Sunrun’s BrightBox and EV-grid integrations—like Ford’s F-150 Lightning partnership—provide diversified revenue streams

- Scale from Vivint merger (2020): Enhanced geographic reach and cost synergies.

Challenges & Threats:

- Policy risk: Sudden removal of Investment Tax Credit (ITC) is a major near-term blow.

- Debt-heavy model: Rising interest rates could strain refinancing.

- Profitability timeline: Still burning cash; costs may rise before economies of scale structure in.

📉 7. Valuation Snapshot

- Forward P/E: Not applicable; negative earnings.

- Price/Sales: ~0.6x vs sector ~1.2x

- Price/Book: Below 1x—potentially undervalued if assets are solid .

Despite unprofitable operations, RUN is trading at deep discounts compared to clean-energy peers—reflective of its macro and regulatory risks.

⚖️ 8. Investment Scenarios for RUN

| Scenario | Description | Price Implication |

|---|---|---|

| Bull | Tax credits reinstated, demand rebounds, Battery/VPP scale | $12–$15 |

| Base | Gradual solar adoption, mild refinancing, stable policy | $8–$10 |

| Bear | ITC rollback enforced, high rates persist, competitors gain | $4–$6 |

RUN is a high-risk, high-reward energy play dependent on policy tides and interest trends.

📊 9. Should You Buy, Hold or Sell RUN Today?

✅ Consider Buying If:

- You’re bullish on clean energy and residential solar adoption.

- You believe policy support may return under future administrations.

- You can tolerate volatility and have a 2–3 year investment horizon.

🤔 Consider Holding If:

- You own RUN already—watch for policy updates and cost improvements.

- You want to average down gradually at sub-$7 levels.

❌ Consider Selling Or Avoiding If:

- You can’t stomach heavy debt and no clarity on profitability.

- You’re risk-averse or need predictable income/returns.

🏆 10. How to Manage RUN Exposure

- Start small: Consider 1–3% of portfolio in speculative energy.

- Use TSLs: Set stop-loss near support ($4.75).

- Monitor policy: Senate/HOUSE actions on clean-energy tax reform weekly.

- Track earnings: Check Q2 (August 4) and Q3 for updated subscriber, revenue, and cash-flow metrics

📅 11. Timeline of Critical Catalysts

- June 2025: Senate bill debate on tax credits.

- July–August 2025: Quarterly earnings, including subscriber growth.

- Late 2025: Potential midterm-driven policy shifts.

- 2026–2027: ITC phase-down effects.

🧩 12. Comparing RUN to Renewable Energy Peers

| Company | Price Range | Analyst Target | Key Strength |

|---|---|---|---|

| SunPower (SPWR) | Volatile | Moderate | Strong panel brand |

| Enphase (ENPH) | $35 area | Cautiously optimistic | Microinverters |

| First Solar (FSLR) | Stable | Clean | Utility-scale |

| SolarEdge (SEDG) | Electric units | Mixed | System focus |

Sunrun is unique—focused on residential installs—whereas peers serve commercial/utility markets.

🧠 13. Final Takeaway

- RUN trades at historically low levels (~$5.78) due to political and economic headwinds.

- Deep discounts imply catch-up upside but depend on policy and execution.

- Analyst targets near $11–$14 show optimism, but more volatility lies ahead.

If you’re bullish on solar adoption, tolerant of market swings, and want payoff in 2–3 years, RUN could offer growth at a bargain. But if you’re looking for stable income or lower-risk stocks, this is likely not a fit.

🚀 Final Thoughts

Sunrun Inc is trading at levels that reflect both pessimism and opportunity. With live quote at $5.78 and high analyst targets, RUN remains a bet on the future of residential solar—dependent on policy outcomes, refinancing success, and scaling residential installs.

If you’re a risk-tolerant investor with a long-term horizon, RUN offers a compelling contrarian play. But success lies in managing policy exposure and debt risk—make sure you’re ready for bumps as solar policy evolves.

Let me know if you’d like a comparison with peers, a technical chart breakdown, or tips on entering RUN at optimal levels.

❓ Frequently Asked Questions

Q1. Why did RUN plunge 40% today?

Congress initiated a full reversal of solar tax credits, spooking investors. RUN dropped to $5.78 from intraday highs around $7.37.

Q2. Is SUNRUN stock undervalued?

Yes, relative to peers. Trading at 0.6x sales and sub-1x book implies undervaluation—if growth and margins rebound.

What’s the consensus price target?

Analysts project $11–$14 range—suggesting 90–150% upside from today’s price.

Q4. What are key risks?

Tax-credit rollback, high debt, macro headwinds, subsidy dependence—all could push price under $5.

Q5. When are earnings?

Next major earnings release: late August 2025. Q2 performance could shift market sentiment.