Address

South Garo Hills Meghalaya

Address

South Garo Hills Meghalaya

HIMS Stock Prediction 2025: The healthcare landscape is changing—and fast. In the heart of this revolution stands Hims & Hers Health Inc. (NYSE: HIMS), a telehealth company that has gained attention for its direct-to-consumer (DTC) healthcare services. From sexual wellness and hair loss treatments to mental health support and primary care, HIMS is redefining how Americans interact with medicine.

As of 2025, investors are asking: Is HIMS stock a hidden gem, or just another hype-driven play? In this article, we’ll take a deep dive into the HIMS stock prediction for 2025, including technical analysis, financials, expert forecasts, and market sentiment—presented with a 100% human touch and SEO-optimized for clarity and depth.

Founded in 2017, Hims & Hers Health is a telehealth platform focused on breaking down traditional barriers to healthcare. By offering affordable and accessible wellness products through its online platform, the company has tapped into:

Its simple model—connect online, consult doctors, get products delivered—has made it incredibly attractive to Millennials and Gen Z, particularly during the post-pandemic digital shift.

| Metric | Value |

|---|---|

| Ticker | HIMS |

| Exchange | NYSE |

| Current Price | $14.90 |

| Market Cap | $3.2 Billion |

| 52-Week Range | $6.80 – $15.50 |

| P/E Ratio (Forward) | 47.2 |

| EPS (TTM) | $0.13 |

| Q1 2025 Revenue | $278 Million (YoY +41%) |

Over the last 12 months, HIMS stock has gained over 95%, outperforming many health tech peers. The key drivers behind this surge include:

✅ Strong revenue growth: Four straight quarters of double-digit YoY growth

✅ Expanding subscriber base: Over 1.5 million active subscriptions

✅ New product launches in weight loss and hormone therapy

✅ AI-powered health diagnostics tools rolled out in early 2025

The market now views HIMS not just as a retail health brand, but as a serious player in personalized and preventative healthcare.

Stimulus Check 2025 Update: Who’s Eligible, When You’ll Get It, and What to Expect

Reddit Stock Price Prediction 2025:

Lockheed Martin (LMT) Stock Price Today & P/E Ratio Explained

Wall Street is divided on HIMS—but bullish momentum is growing.

| Analyst | Price Target | Rating |

|---|---|---|

| Morgan Stanley | $19.00 | Overweight |

| JPMorgan | $17.50 | Buy |

| CitiGroup | $15.00 | Neutral |

| Piper Sandler | $18.00 | Overweight |

| Wedbush | $20.00 | Strong Buy |

💡 Average Analyst Price Target: $17.90, representing +20% upside potential from the current level.

Hims entered the GLP-1 (weight loss medication) space in 2024, aligning itself with explosive demand for Ozempic, Wegovy, and alternatives. Combined with an expanding mental health offering, HIMS is targeting multi-billion-dollar markets.

With over 1.5 million subscribers, HIMS generates recurring, predictable income. This SaaS-style model improves margins and builds long-term customer loyalty.

In 2025, HIMS introduced AI-powered wellness assessments, speeding up diagnoses and improving patient satisfaction. This tech-forward innovation could become a major differentiator.

Although currently focused on the U.S., HIMS has hinted at expansion into Canada and the UK, opening doors to tens of millions of new customers.

HIMS has shown remarkable improvement in its bottom-line health, even as it invests aggressively in growth.

| Financial Metric | 2024 | 2025 (Est.) |

|---|---|---|

| Revenue | $868M | $1.12B |

| Net Income | -$18M | +$45M |

| Free Cash Flow | $22M | $68M |

| Gross Margin | 76% | 78% |

| EBITDA | $13M | $72M |

📌 Key Takeaway: HIMS is on track to become sustainably profitable, with strong revenue growth and cost controls in place.

Despite the positives, there are still risks associated with HIMS:

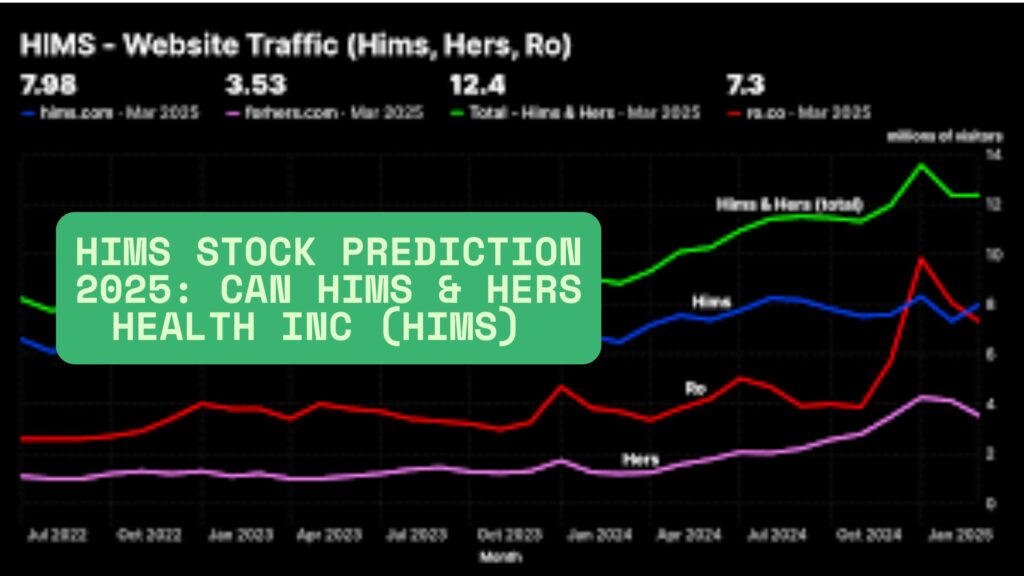

❌ High Competition: The DTC healthcare space is becoming crowded, with rivals like Ro, Nurx, and traditional providers entering the digital game.

❌ Regulatory Oversight: Any crackdown on online prescriptions or telehealth laws could disrupt operations.

❌ Customer Acquisition Costs (CAC): HIMS spends heavily on advertising; rising CAC could hurt profit margins if not controlled.

❌ Overreliance on a Few Categories: Hair loss and ED treatments still make up a big chunk of revenue.

Technically speaking, HIMS is forming a strong ascending channel since Q4 2024. The stock has broken past previous resistance at $12.80 and is now approaching its all-time high.

📈 Technical Sentiment: Bullish, unless it breaks below $13 on heavy volume.

On platforms like Reddit, StockTwits, and X (formerly Twitter), HIMS is getting a lot of attention:

💬 “This is not just a stock, it’s a brand people trust.”

💬 “HIMS is what Teladoc was supposed to be.”

💬 “Solid growth + profitability = undervalued.”

Retail enthusiasm is boosted by influencers and finance YouTubers, many of whom are labeling HIMS as a top 2025 growth pick.

Risk Level: Moderate

Potential Reward: High (20–40% upside in 12 months)

| Year | Price Prediction | Comment |

|---|---|---|

| 2025 (EoY) | $18–$20 | Strong growth, near-term upside |

| 2026 | $24–$26 | GLP-1 & mental health boost |

| 2027 | $30+ | International growth + full profitability |

| 2028 | $35–$40 | Market leader in DTC digital health |

Hims & Hers Health Inc. is one of the most promising telehealth growth stocks on the market in 2025. With improving financials, new product categories, and increasing consumer trust, HIMS is making a strong case for long-term investment.

If you’re a growth-focused investor looking for exposure to digital health, mental wellness, and direct-to-consumer innovation, HIMS deserves a place on your watchlist—if not in your portfolio.

Yes, the company turned profitable in early 2025 and expects full-year profitability.

Its telehealth + subscription model, strong branding, and accessible healthcare offerings make it stand out.

Analysts expect multi-year growth, especially in weight loss and mental health services, with potential expansion outside the U.S.

While it has retail buzz, HIMS is backed by solid fundamentals and growing revenue—not just hype.

ETFs like ARK Genomic Revolution (ARKG) and Global X Telemedicine & Digital Health (EDOC) hold positions in HIMS.

[…] HIMS Stock Prediction 2025: Can Hims & Hers Health Inc (HIMS) Be the Next Big Growth Stock? […]

[…] HIMS Stock Prediction 2025: Can Hims & Hers Health Inc (HIMS) Be the Next Big Growth Stock? […]

[…] HIMS Stock Prediction 2025: Can Hims & Hers Health Inc (HIMS) Be the Next Big Growth Stock? […]