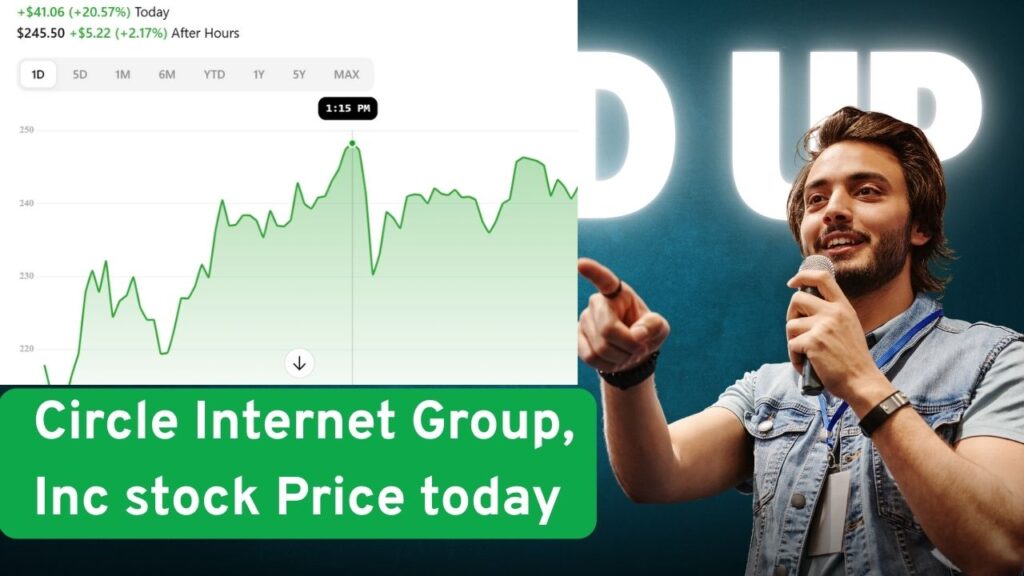

Here’s today’s snapshot of CRCL (Circle Internet Group Inc.):

- Current Price: $240.28, up about 20% from yesterday’s close

- Intra‑day Range: $206.17 – $248.88

- Trading Volume: Massive at ~92 million shares, nearly double its 3-month average

📈 Why Is CRCL Surging Today?

- Regulatory Tailwinds

The recent momentum comes amid a Senate-approved stablecoin bill—which could open doors for USDC’s broader adoption. That boosted investor sentiment substantially - Bullish Analyst Outlook

Seaport Global just initiated coverage with a Strong Buy rating and a $235 price target, citing expectations of robust FY26 growth (~$3.5B revenue, $1.56 EPS) - ETF Repositioning

Notably, ARK funds have been trimming their CRCL holdings—selling around 609k shares (~$121M) recently. That shift might fuel short-term volatility even as regulatory news supports momentum

Tesla Stock Prediction 2025: Will TSLA Accelerate or Hit the Brakes?

Reddit Stock Price Prediction 2025:

Lockheed Martin (LMT) Stock Price Today & P/E Ratio Explained

⚖️ Technical & Sentiment Snapshot

- MarketClub: Long-, intermediate-, and short-term trends remain in the green with a +80 momentum score, despite a minor pullback .

- TradingView: Oscillators and moving averages are currently neutral, suggesting consolidation before any potential breakout.

- Stocktwits sentiment: CRCL ranks among the top trending tickers (#8 today), with over 10,000 watchers and a large volume surge .

🧭 Balance of Opportunity vs. Risk

Pros:

- Regulation could legitimize Circle’s stablecoin (USDC) and fuel long-term growth.

- Institutional ratings reflect strong revenue/EPS outlooks.

Risks:

- Valuation is extremely rich:

29× trailing sales and billions higher than IPO price ($31) - Heavy volume and ARK selling may introduce short-term swings.

✅ Summary for Investors

CRCL has exploded post-IPO, rallying from ~$31 to $240+ in just weeks—driven by regulatory optimism, an analyst “Strong Buy,” and strong market interest. But with elevated valuation multiples and profit-taking by major institutions (like ARK), it’s poised for both upside and potential volatility.

📌 CRCL Stock Price Today: Frequently Asked Questions (FAQ)

Q1: What is the current stock price of CRCL (Circle Internet Group Inc.)?

As of June 21, 2025, the current price of CRCL stock is $240.28, showing a sharp increase of over 20% from the previous day. The stock hit an intraday high of $248.88 and a low of $206.17, reflecting strong investor interest and high volatility.

Q2: Why is CRCL stock trending today?

CRCL stock is trending due to several factors:

A new U.S. stablecoin regulation bill that could boost adoption of USDC (issued by Circle).

Positive analyst coverage, with Seaport Global rating CRCL a “Strong Buy.”

Increased trading volume, fueled by both retail and institutional attention.

Q3: Is CRCL a good stock to buy right now?

It depends on your investment strategy. CRCL is showing strong upward momentum and long-term promise due to regulatory clarity around stablecoins. However, it is also trading at a very high valuation and is subject to short-term volatility—especially after major investors like ARK offloaded shares recently.

Q4: Who owns CRCL stock?

CRCL is publicly traded and owned by a mix of retail and institutional investors. Major stakeholders include:

ARK Invest (Cathie Wood’s fund) — although they’ve recently reduced their holdings.

Large ETFs and crypto-aligned funds tracking fintech and blockchain-based companies.

Q5: What does Circle (CRCL) actually do?

Circle Internet Financial is the issuer of USDC (USD Coin), the second-largest regulated stablecoin in the world. Its ecosystem powers billions in daily transactions and has deep integrations with crypto platforms, DeFi, and traditional finance systems.

Q6: When did CRCL go public?

CRCL officially went public via a direct listing in 2025, debuting at a price around $31. Since then, it has surged to over $240 as of June 2025, largely driven by optimism over stablecoin regulation and increased USDC adoption.

Q7: What are the risks of investing in CRCL?

Risks include:

Regulatory uncertainty in the crypto space despite recent progress.

High valuation, currently trading well above its IPO.

Volatility, as the stock is heavily influenced by news cycles and crypto market trends.

Q8: How can I invest in CRCL stock?

You can buy CRCL shares through most online brokers like Robinhood, E*TRADE, Fidelity, Charles Schwab, or Webull. Just search for the ticker symbol CRCL, place a market or limit order, and decide how many shares you want to buy.

Q9: What is the long-term outlook for CRCL stock?

The long-term outlook for CRCL is cautiously bullish. If stablecoin regulation continues to evolve favorably and USDC adoption increases globally, Circle could play a central role in the next generation of digital finance. However, the company must scale efficiently, maintain trust, and fend off competition from PayPal, Tether, and others.

Q10: What’s driving CRCL’s daily price fluctuations?

CRCL’s price is influenced by:

Stablecoin regulation updates

Crypto market sentiment

Analyst upgrades or downgrades

Institutional buying/selling (like ARK Invest)

Earnings reports and revenue growth updates