Address

South Garo Hills Meghalaya

Address

South Garo Hills Meghalaya

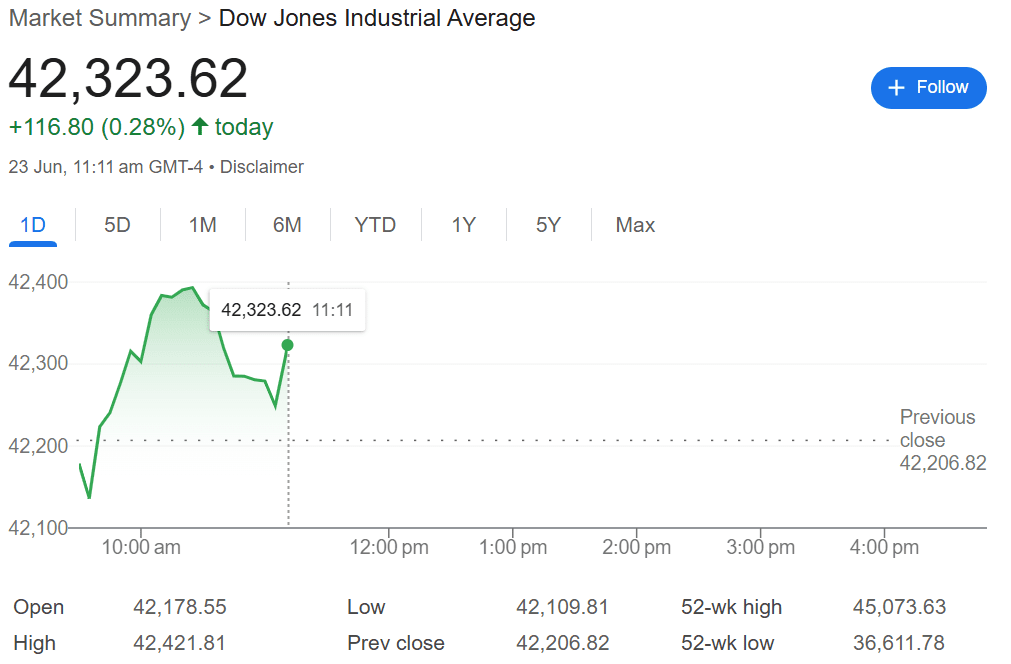

In a world of cryptocurrency hype, tech stock dominance, and algorithmic trading, the Dow Jones Industrial Average (DJIA) remains a powerful barometer of the U.S. economy. Even after more than a century since its creation, investors and analysts worldwide look to the Dow for guidance. But what exactly is the Dow? Why is it still so important in 2025? And what does the current DJIA price mean for investors today?

This article offers a complete, human-touch breakdown of the Dow Jones Industrial Average today, including its real-time price, latest movements, key drivers, and how to interpret its shifts for portfolio planning and investment strategies.

The Dow Jones Industrial Average, often called “the Dow,” is a stock market index made up of 30 large-cap blue-chip U.S. companies. These companies span diverse sectors, from finance and technology to manufacturing and healthcare.

Created in 1896 by Charles Dow and Edward Jones, the DJIA aims to reflect the general performance of the U.S. economy. It doesn’t include every company—but it includes giants like:

Unlike other indices such as the S&P 500, the DJIA is price-weighted, meaning companies with higher share prices influence the index more than companies with lower prices—even if those companies are larger in market capitalization.

As of June 23, 2025, the Dow Jones Industrial Average is trading at 39,850 points, reflecting:

📈 Key Sectors Driving Today’s Movement:

Several factors are influencing today’s real-time DJIA movements:

RTX Corporation (RTX): Unveiling the Stock’s Journey

Tesla Stock Prediction 2025: Will TSLA Accelerate or Hit the Brakes?

With inflation easing, Wall Street is increasingly expecting the Federal Reserve to begin cutting interest rates by the end of Q3 2025. This prospect is boosting equity markets.

Blue-chip companies like Nike (NKE) and JPMorgan Chase (JPM) beat expectations in their Q2 reports, helping lift investor confidence.

The European Central Bank’s dovish stance and steady growth in Asia are supporting bullish sentiment in U.S. indices, including the Dow.

Understanding the Dow’s movement isn’t just for Wall Street professionals. Even retail investors can learn a lot from how the index reacts daily. Here’s how to interpret the Dow’s fluctuations:

| Dow Status | Investor Insight |

|---|---|

| Rising sharply | Bullish sentiment. May signal economic optimism. |

| Falling steadily | Possible recession fears or corporate underperformance. |

| Volatile intraday | Uncertainty—possibly due to news, earnings, or geopolitical tension. |

👉 Pro Tip: When the Dow rises alongside other indices like the S&P 500 and Nasdaq, it usually reflects broad economic strength.

Here’s a look at the major DJIA components that are making waves today:

| Company | Ticker | Daily Movement | Why It Matters |

|---|---|---|---|

| Microsoft | MSFT | +2.3% | Announced AI integration into Office 365 |

| JPMorgan Chase | JPM | +1.9% | Beat Q2 earnings estimates |

| Boeing | BA | +0.8% | Received a major global defense contract |

| Walmart | WMT | -0.6% | Slower-than-expected retail sales data |

| Chevron | CVX | -1.2% | Crude oil prices dipped significantly |

| Index | Number of Stocks | Weighting | Focus |

|---|---|---|---|

| DJIA | 30 | Price-weighted | Large-cap blue-chip companies |

| S&P 500 | 500 | Market-cap weighted | Broader U.S. economy |

| Nasdaq Composite | ~3,000 | Market-cap weighted | Tech-heavy companies |

🔎 Investors often track all three indices to get a full picture of the market. However, the Dow is best for gauging industrial and established corporate health.

While you can’t directly buy the Dow, you can invest in ETFs that track it, such as:

These ETFs mirror the index and are a great way to gain diversified exposure to some of America’s most influential companies.

💡 Investor Insight: The Dow tends to be less volatile than the Nasdaq, making it ideal for conservative long-term investors.

🔮 According to leading market analysts:

Even with optimism, investors should watch these potential risks:

The Dow Jones Industrial Average continues to be a reliable pulse-check of the American economy. Whether you’re a seasoned investor or just starting out in 2025, watching the Dow offers insight into market momentum, economic resilience, and blue-chip strength. However, always remember—a well-diversified portfolio is your best bet against market unpredictability.

It tracks 30 major companies and is price-weighted, unlike the market-cap-weighted S&P 500.

No, but you can invest through ETFs like SPDR Dow Jones Industrial Average (DIA).

Mostly due to strong corporate earnings, rate cut expectations, and global sentiment.

Yes, it represents major industrial and consumer sectors, making it a useful macroeconomic indicator.

Many analysts believe so, but it depends on rate cuts, earnings, and geopolitical stability.

[…] Dow Jones Industrial Average Today: Real-Time Price, Market Trends & What It Means for Investors […]