1. 📈 What’s the Current RTX Stock Price?

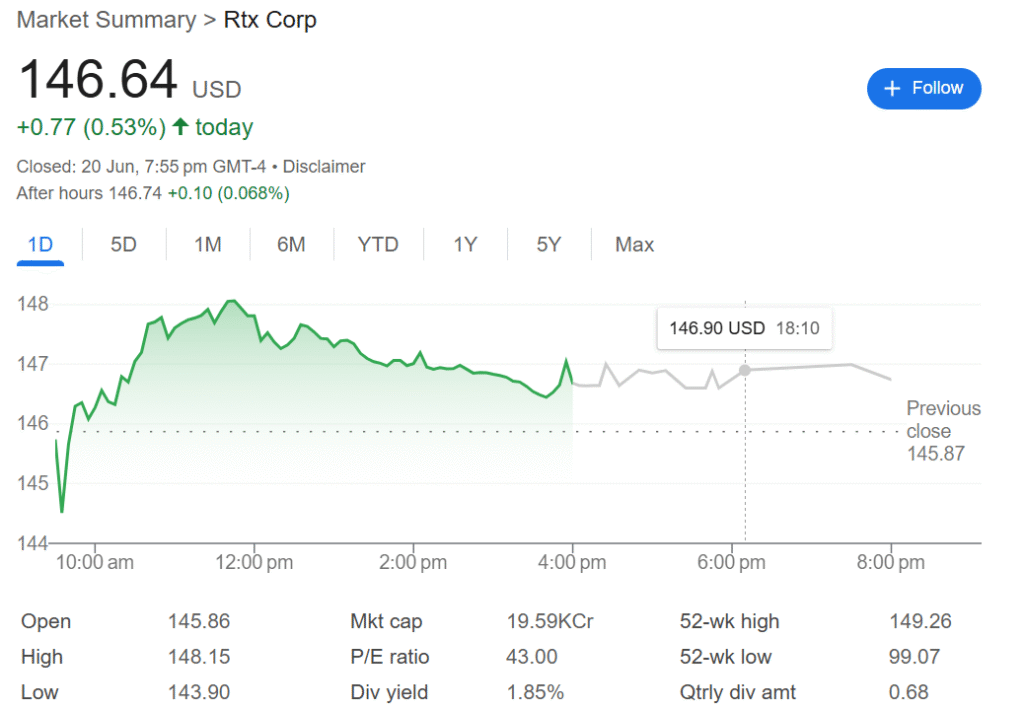

As of the latest close:

- Price: $146.64

- Change: +$0.81 (+0.55%)

- Intraday Range: $144.00 – $148.12

- Volume: 9.22 million shares

- 52‑Week Range: $99.07 – $149.26

RTX, a leader in aerospace and defense, has seen steady appreciation, nearing its 52‑week high. Let’s explore the forces behind this momentum.

- Circle Internet Group, Inc stock Price today

- Tesla Stock Prediction 2025:

- Stimulus Check 2025 Update:

- Reddit Stock Price Prediction 2025:

2. The Story Behind RTX: From Raytheon to RTX

- Origins: RTX traces its roots to Raytheon (founded 1922), a pioneer in electronics and defense .

- Merger: In 2020, Raytheon merged with United Technologies Corp, forming Raytheon Technologies.

- Rebrand: In July 2023, the company rebranded as RTX Corporation, consolidating its business lines into:

- Pratt & Whitney (jet engines)

- Pratt & Whitney Canada

- Collins Aerospace (avionics, aircraft systems)

- Raytheon (missiles, defense systems)

3. Why RTX Is One of the Most Watched Defense Stocks

- Diversified Segments: From aircraft engines to missile defense, RTX’s portfolio spans commercial and government sectors .

- Defense Tailwinds: Conflicts in Ukraine and the Middle East have spurred global military spending, benefiting RTX .

- Commercial Demand: Post-pandemic travel rebound has lifted Pratt & Whitney and Collins Aerospace.

- Strong Backlog: As of late 2024, RTX’s order backlog in defense reached ~$93 billion – up from ~$78 billion a year prior .

4. Recent Financial Performance & Earnings Highlights

- Q4 2024 Earnings: EPS of $1.54 on $21.6 billion revenue, beating expectations of $1.38 and $20.5 billion .

- 2025 Forecast: Revenues projected at $83–84 billion, EPS estimated between $6–6.15 .

- Analyst Ratings:

- Buy: Rob Stallard set a $155 target

- Hold: Peter Arment valued shares at $136

This solid financial backdrop is keeping RTX firmly on the radar.

5. Stock Technicals: Gauging Momentum & Strength

Relative Strength (RS) Ratings

- RS climbed from 67 to 81 (April 2025), entering top-tier territory (80+) .

- An RS over 80 often signals leadership and potential for strong future moves.

- While RTX isn’t in a buy zone right now, the statistical setup suggests bullish momentum is building .

Price Patterns & Buy Zones

- RTX broke out of a cup base in January 2025 at ~$128.70 and stayed within the 5% buy zone since .

- On March 14, it regained a buy point after support from the 21-day EMA, showing resilience .

Historical Highs

- All-time closing high: $148.48 (June 17, 2025) .

- 52-week high: $149.26, just 1–2% above current levels .

6. Stock Price Journey: June 2024 – June 2025

Analyzing the six months up to June 2025 from investing.com:

| Date | Close | Notes |

|---|---|---|

| Jun 20, 25 | 146.64 | +0.53% |

| Jun 17, 25 | 148.48 | Hit all-time high |

| Jun 13, 25 | 145.69 | +3.34% weekly gain |

| May 29, 25 | 134.80 | Continued upward trend |

| May 1, 25 | 127.41 | Pre-cup breakout in April |

| Apr 30, 25 | 126.13 | Stable around mid-120s post-earnings |

The stock has consistently trended higher, showing strong recovery and upward momentum .

7. Long-Term View: Historical Performance

- 2024: Avg $105.17, ended at $114.55 (+40.8%) .

- 2025 YTD: Avg $128.65, currently ~146.64 – ~28% improvement .

- A consistent rising trajectory since merger; RTX has risen from the low $80s in 2022–2023 to mid-$140s.

8. Key Drivers Behind RTX’s Rising Stock Price

- Geopolitical tensions (Ukraine, Middle East) → higher defense budgets .

- Commercial aerospace recovery → increased engine and systems demand.

- Strong earnings and guidance, along with bullish analyst sentiment .

- Technical momentum, with RS rating above 80 signaling leadership .

- Massive order backlog, providing long-term revenue visibility .

9. Risks to Watch

- Valuation Premium: Trading near 52-week highs; profit-taking could occur.

- Geopolitical shifts: Sharp de-escalation may reduce defense spending.

- Regulatory & legal exposure: Ongoing settlements (e.g., export-control fines paid in 2024) warrant monitoring .

- Economic slowdown: Reduced air travel demand could impact commercial aerospace.

10. Analyst & Expert Views

- Rob Stallard (Vertical Research): Buy – $155 target .

- Peter Arment: Hold – $136 target, noting defense backlog remains a tailwind .

- Investor’s Business Daily: RTX now has RS 81 but not in buy zone; still a top‑20 big‑cap stock with strong relative strength .

11. What Investors Should Do Now

- Monitor support levels – particularly around $140 and the 21-day/50-day moving averages.

- Watch RS & buy-zone signals – a new base formation could create a fresh entry point .

- Stay updated on earnings and order book – Q2 2025 earnings expected in late July/August.

- Diversify – RTX fits in aerospace/defense but balance with other sectors and asset classes.

12. Final Thoughts

RTX combines strong fundamentals, resilient technicals, and a favorable external environment. With a robust order book, rising commercial demand, and a momentum-fueled stock, it’s poised for continued gains.

Of course, any investment carries risks—valuation, geopolitics, macro cycles—but for investors aligned with defense and aerospace themes, RTX represents a compelling pick in mid-2025.

Appendix: Quick Facts & Data Table

| Metric | Value |

|---|---|

| Current Price | $146.64 |

| Market Cap | ~$196 billion |

| 52-Week Range | $99.07 – $149.26 |

| Volume (avg/day) | ~9 million shares |

| EPS (Q4 2024) | $1.54 |

| Revenue (Q4 2024) | $21.6 billion |

| FY2025 Revenue Est. | $83–84 billion |

| RS Rating | 81 (April 2025) |

| Buy/Zones | Breakout at $128.70; Buy zone since |

| All-Time Close High | $148.48 (June 17, 2025) |

| Year-End 2024 Price | $114.55 (+40.8% YoY) |

From its rich legacy to modern-day momentum, RTX stands at the intersection of innovation, defense strength, and commercial aerospace recovery. For informed investors, this article should serve as a valuable guide into the company’s stock dynamics in 2025.

Frequently Asked Questions (FAQs)

Q1: Is RTX a buy at today’s price (~$146.64)?

Some analysts are bullish ($155), others cautious ($136). It’s not currently in a clear technical buy zone, so waiting for a new setup might be prudent .

Q2: What drives RTX’s revenue growth?

Q3: How significant is the $93B backlog?

It provides strong visibility into future revenue and underscores RTX’s long-term strength .

Q4: How does RTX compare to other defense stocks?

RTX is ranked #18 in the aerospace/defense group. Other top names include Elbit Systems, Embraer, Heico .

Q5: When is RTX’s next earnings release?

Q2 2025 expected in late July or early August, based on calendar.